Rent began to reverse, office vacancy remained near record highs, banks failed and lending got tricky in 2023. Where are we headed next?

Investors knew they were in for a roller coaster ride in 2023. What they still don’t know is where the ride is heading next.

Pandemic-era highs for virtually all sectors of real estate led to uncertainty in markets across the U.S. Rent began to reverse, office vacancy remained near record highs, banks failed and lending got tricky.

On the Property Portfolio beat at Inman, we focus on long-term rentals, short-term rentals, institutional investors, property management and the broader business of making money by using real estate as an investment. Here’s what we watched in 2023.

2023 shifted in renters’ favor

Renters gained the upper hand in markets across the country as a rush of newly built apartments were completed, giving renters more options to choose from and helping cool down the growing cost of monthly rent in 2023.

That was welcome news for many players, even including some investors who dreaded the prospect of a long period of high interest rates if the Federal Reserve failed to cool inflation quickly.

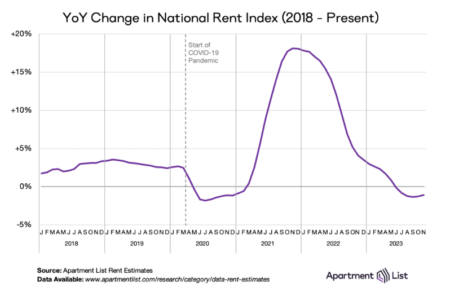

Renters received a reprieve after two years of unprecedented rent growth driven by the COVID housing market. It now costs $1,499 per month to rent a one-bedroom home and $1,856 per month for two bedrooms. Rent fell about 1.1 percent in 2023, Apartment List reported.

While rent is falling entering 2024, it is still about $250 more per month than it was three years ago, according to Apartment List.

All eyes on office buildings as businesses set ‘new normal’

In April, Redfin CEO Glenn Kelman told employees they’d be coming back to the office on a part-time basis. It was a departure from the three years when the real estate portal allowed its employees to work remotely full time.

It also came at a time when cities across the country are grappling with vacant office buildings that are helping drive down the value of commercial real estate.

Kelman’s change meant that hundreds of employees would be coming back to a downtown office building at a time when buildings across the country are sitting largely empty.

Experts said they expect that businesses will continue tweaking their policies on where employees can work, final moves that will impact demand and values for office buildings. Meanwhile, nearly $150 billion of loans on those office buildings are coming due this year, according to CommercialEdge.

“In 2024, it’s game time,” said Scott Rechler, chief executive of RXR Realty, an owner of New York office buildings, told The Wall Street Journal. “Owners and lenders are going to have to come to terms as to where values are, where debt needs to be and right-sizing capital structures for these buildings to be successful.”

Institutional investors expect prices to fall throughout 2024 before having a chance to rebound.

Falling inflation relieves pressure on Fed to keep rates high

By the middle of the year, economists began seeing signs that the Federal Reserve’s rapid increase in the federal funds rate was helping cool inflation.

At the time, it wasn’t clear how long the Fed would continue its rate-hiking cycle. But a wave of reports heading into summer gave investors and economists hope that the Fed would soon begin decreasing the rates that impact borrowing costs.

After a few more months of positive news about inflation, the Fed announced in December it was projecting three rate cuts in 2024, news that sent stock markets soaring to new record highs.

Investors now expect that the federal funds rate will be at least 100 basis points lower than it is now, according to CME Group.

Airbnb sets target squarely on hotel industry

Airbnb is by far the short-term rental powerhouse. In 2023, the firm and its leaders set their sights not on competing rental companies but on a much larger rival. Airbnb is actively working to grab market share from the much larger hotel industry.

“While the hotel CEOs have said they expect demand to drive prices up this summer, we want to actually have prices moderate,” CEO Brian Chesky said last year. “We think that’s going to bring in a whole new generation of travelers to Airbnb.”

Hotels have an inherent advantage over the newer short-term rental industry as cities across the world enact regulations that can vary widely. Airbnb faced a setback in New York City, which effectively banned tens of thousands of short-term rentals in September.

Still, the city represented less than 1 percent of Airbnb’s total revenue, analysts said. The real threat to Airbnb’s ongoing expansion plans would come if more big markets replicated New York City’s regulations in 2024.

Investors look to get creative in high-rate environment

Real estate investors targeting single-family rentals were stymied by a lack of supply and high interest rates in 2023, sending many in search of elusive deals that required many to get creative.

In the absence of distressed homes to buy, fix and resell at a profit, and with an ongoing slowdown in rent growth, investors said they were working with homeowners on ways to work together without actually buying or selling homes.

“I always say the market predicts your investment strategy,” real estate investor Mike DelPrete said. “You have to be well-versed in each strategy. You’re like a doctor, you’re diagnosing each situation.”

Investors began looking for subject-to financing, where the investor makes payments on an existing mortgage and on behalf of the owner, allowing for better-than-market rate borrowing costs.

Another type of creative financing that emerged in 2023 was a seller carryback, where a property owner has paid off a mortgage but doesn’t necessarily need or want to sell the house. The investor and owner agree to terms based on the ability of the property to cashflow.

Apartment pipeline dries up

High lending costs — paired with high prices for buildings and labor — helped to shut off the development pipeline for new apartment buildings across the country.

Buildings that were under construction in 2023 will be finished this year, adding to what has become a glut of new supply in markets across the country. That should keep downward pressure on rents, industry experts said.

Long-term, though, it may spell a new period of high rent growth after the rentals that are being finished now are filled and there’s little new supply coming behind it.

“I suspect rents nationally will remain fairly flat for a while, especially given that new supply volumes will further spike (and peak) in 2024,” Jay Parsons, chief economist of rent data firm RealPage, said. “Supply will drop off beginning in 2025 and more dramatically by 2026, which (assuming a decent economy) should allow demand to catch up to supply and rents to rebound.”

Source: inman.com