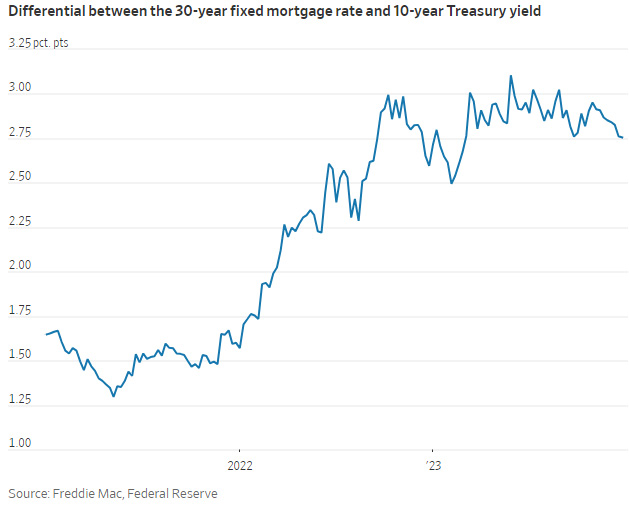

The differential between 30-year mortgage rates and benchmark Treasury yields has been shrinking for eight straight weeks

A key factor that pushed up mortgage rates over the past two years is now starting to pull them down.

Average 30-year fixed mortgage rates have been higher than usual relative to the benchmark Treasury yields they typically track. But that extra differential, or spread, has been shrinking for eight straight weeks. It is now at its lowest since March.

The 30-year mortgage rate has fallen by more than a percentage point recently to 6.62%, according to data released Thursday by mortgage giant

. The shrinking spread between that and the 10-year Treasury yield amounts to roughly one-sixth of the decline. (Treasury yields have also fallen sharply.)

The spread is still far larger than its historical average. But its downward trend is giving mortgage rates an extra push lower. It is a boon to would-be home buyers who have been sidelined by high borrowing costs, as well as to hard-up mortgage lenders and real-estate agents.

“Rates have come down since October and everyone in the industry is excited about that,” says Adam Haller, a mortgage-loan officer based in Raleigh, N.C.

The reason the spread exists in the first place has to do with the machinery behind the home-lending industry.

Once loans are extended by mortgage companies, they are typically packaged into bonds and sold to investors. Investors demand more yield on mortgages than Treasurys to compensate for the risks of holding them. That gets baked into the rate borrowers receive.

These days, investors have lots of reasons to demand more yield. For one, there is the risk that mortgages extended today won’t be around tomorrow. If rates fall, as many expect, homeowners will refinance into lower-rate loans, cutting off investors’ streams of income.

Take Dan Meier, who got a mortgage rate of 7.25% in September when he and his wife bought a home for $725,000 in Eugene, Ore. The empty-nesters took the rate because they found a home they liked, but it has cost them. They have cut back on other spending like eating out.

As soon as it makes sense to refinance, they plan to do so, he says. “We assumed that we were likely at the higher end of mortgage rates.”

The biggest buyers of mortgages, such as banks and the Federal Reserve, have also been buying less since the Fed started lifting interest rates in early 2022 to combat skyrocketing inflation.

The central bank last month signaled it is likely finished raising rates and could cut rates this year as inflation has been falling and the economy has remained strong. That is reviving investor demand for mortgages somewhat and pushing down the spread.

“The people who are really holding these financial instruments seem a lot less worried about this market,” said Wendy Edelberg, a senior fellow in economic studies at the Brookings Institution.

Mortgage bankers and others in the housing industry have fixated on the spread. If it returns to historical levels, it could drum up demand for new mortgages. At current rates, bankers say there is still not likely to be huge mortgage demand.

“It’s not low enough to induce more consumers to buy more houses,” said Thuan Nguyen, who owns Loan Factory, a California-based mortgage broker. “We aren’t out of the woods yet.”

The mortgage industry has been in a deep freeze. The rapid rate increases of 2022 quickly swung the industry from boom to bust. Record-low interest rates during the pandemic had prompted millions of homeowners to refinance and sparked home sales.

Haller, the loan officer, took a job at a mortgage company in the middle of 2021, when interest rates were super low and the mortgage market was booming. He worked 12-hour days.

By the middle of 2022, the company filed for bankruptcy and let go of many employees. He then got hired on as a loan officer at a mortgage brokerage, but that company soon shut down too.

He now works at an independent mortgage lender. Recently, with rates falling, he has been more optimistic.

“As rates come down, and the volume picks up, I do think we will see the spread contracting more,” he says.

Source: wsj.com